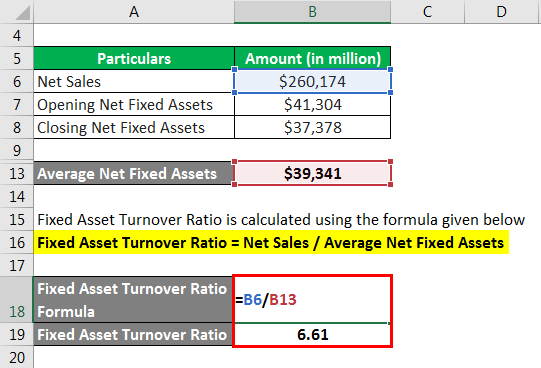

For example, if your asset total as of January 1 was $44,000 and the ending total as of December 31 was $51,750, you would add them together and then divide by two.īy performing this calculation, you can see that your average asset total for 2019 was $47,875. Once you have the balances, simply add them together and divide by two to calculate your average asset value for the year. If you’re keeping books manually, you’ll need to access both balances from your ledger. Do this by running a balance sheet dated January 1, 2019, and then running a second balance sheet dated December 31, 2019. The next step will calculate your average asset value for the year. Calculate average asset value for the year Be sure your net sales total is the figure left after sales adjustments and returns have been accounted for, otherwise the ratio will be incorrect.įor the sake of completing the ratio, let’s say that your net sales for the year was $128,000, which you’ll use when calculating the asset turnover ratio.

FIXED ASSET TURNOVER MANUAL

If you’re using a manual ledger system, you’ll calculate your net sales from your sales journal. If you’re using accounting software, this is as easy as running a year-end income statement for 2019, or whatever year you’re calculating the asset turnover ratio for. If not, you’ll need to find them in your manual ledger or spreadsheet.Įven with accounting software, you’ll likely calculate the ratio separately, since very few small business accounting programs can create accounting ratios. If you’re using accounting software, you can find these numbers on your income statement and balance sheet.

FIXED ASSET TURNOVER HOW TO

How to calculate the asset turnover ratioĬalculating your asset turnover ratio is a quick three-step process. Once you have these numbers, you can use the formula to calculate the asset turnover ratio for your business. The asset turnover ratio is a simple formula that anyone can calculate. You’ll simply need the total net sales for the period in which you’re calculating the ratio and your total average assets for the period. The asset turnover formula is a simple equation you can calculate quickly. In either case, calculating the asset turnover ratio will let you know how efficiently you’re using the assets you have.

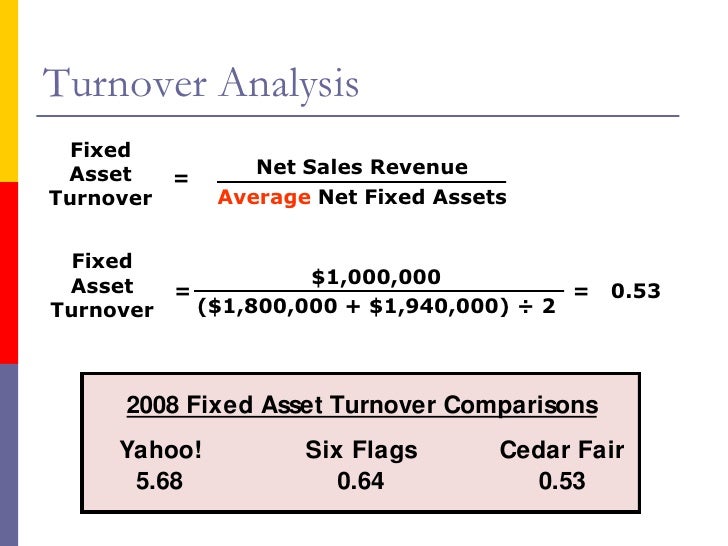

While that’s simple enough, the results provided by the asset turnover ratio can provide an insight into your business operations that can directly affect future decision-making.įor example, as a business owner, you have assets.įor sole proprietors, those assets may consist of a checking account and a savings account, along with a computer and printer, while larger businesses may have a wide variety of assets including a building, an industrial plant, machinery and equipment, a vehicle, along with multiple bank accounts and a line of credit. The asset turnover ratio compares sales revenue to total assets. Image source: Author Overview: What is the asset turnover ratio? The fixed asset turnover ratio is a task that should be checked off your to-do list. Learn what this ratio measures and how the information calculated can help your business. The asset turnover ratio measures how efficiently a business uses their assets to create sales.

One ratio that businesses of all sizes may find helpful is the asset turnover ratio. A must for larger businesses, even small businesses will find accounting ratios effective. Learn more about this ratio and how it can help your business.Īccounting ratios are an important measurement of business efficiency and profitability.

The asset turnover ratio is an accounting ratio that measures the ability of your business to use its assets to generate revenue.

0 kommentar(er)

0 kommentar(er)